Traveling in 2026 is easier, faster, and more digital than ever before. Whether you are traveling for business, remote work, study, or leisure, one thing remains constant: you need a reliable way to access your money abroad without losing a chunk of it to unnecessary charges. This is where Best Travel Debit Cards come in.

Here are some of our popular posts: Top 10 best website builders, Best super foods for a healthy lifestyle, the unlimited list of free productivity apps, Best freelance site to find remote jobs, top 10 productivity hacks for entrepreneurs , 10 best side hustles to make extra money online, best online courses for learning digital skills, top 10 best free coding website

Many travelers still rely on cash exchanges or traditional bank cards, only to discover hidden foreign transaction fees, poor exchange rates, and ATM charges that quietly eat into their budget. Choosing the right travel debit card with no foreign fees can make a noticeable difference in how much you actually spend and how stress-free your trip becomes.

In this comprehensive guide, we will walk through everything you need to know about Best Travel Debit Cards in 2026. You will learn what debit cards are and how they differ from other cards, the key advantages of using a travel debit card, what to consider before choosing one, and a detailed breakdown of the top 10 Best Travel Debit Cards with no foreign fees in 2026. We will also wrap things up with practical tips for using your travel debit card wisely and a clear call to action to stay connected with our blog.

What are debit cards, and how are they different from other cards

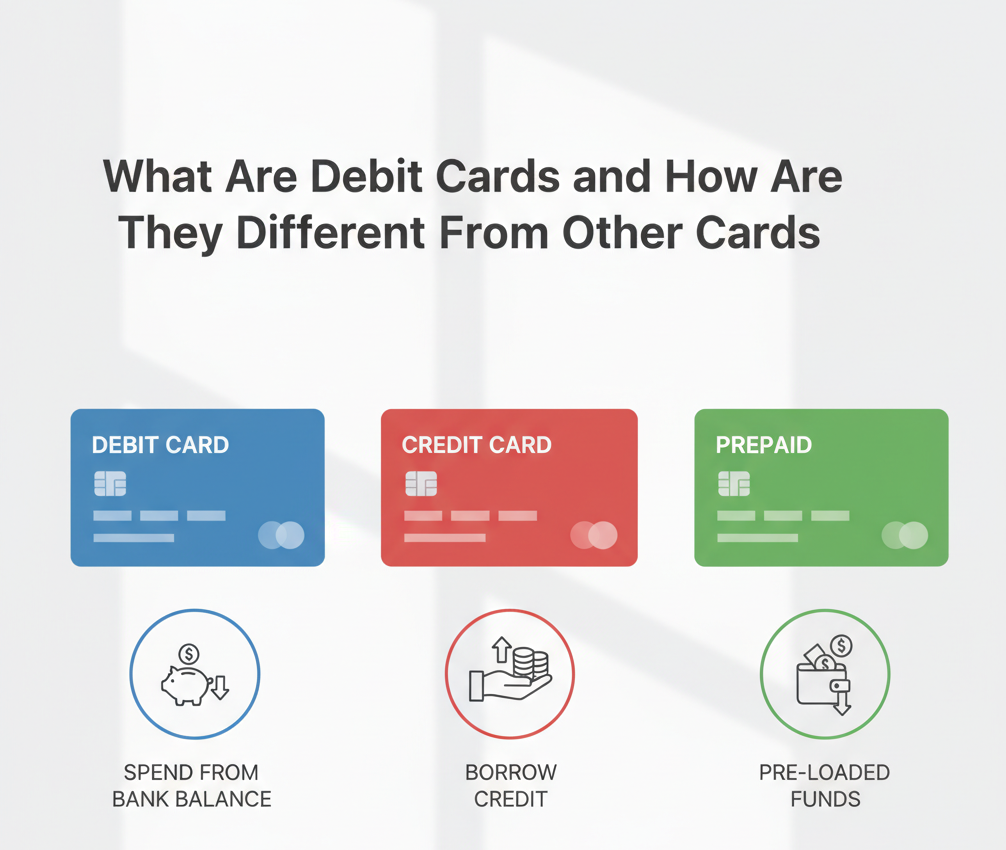

A debit card is a payment card that allows you to spend money directly from your bank account. When you use a debit card, the funds are deducted almost immediately from your available balance. This makes debit cards straightforward, transparent, and easier to control compared to other payment options.

Debit cards differ significantly from credit cards. Credit cards allow you to borrow money from a financial institution up to a set limit, which you repay later. While credit cards can offer rewards and buyer protection, they also come with interest charges if balances are not paid on time. Debit cards, on the other hand, only let you spend what you already have, which helps many travelers avoid debt.

Prepaid travel cards are another alternative, but they often require you to load money in advance and may have maintenance, reload, or inactivity fees. Many modern travel debit cards combine the flexibility of prepaid cards with the simplicity of a traditional bank account, without the excessive fees.

The biggest distinction that matters for travelers is fees. Traditional debit cards often charge foreign transaction fees, international ATM withdrawal fees, and use unfavorable exchange rates. Best Travel Debit Cards are designed specifically to eliminate or reduce these costs, making them ideal for international use in 2026.

Top 10 advantages of using Best Travel Debit Cards

Using one of the Best Travel Debit Cards offers several practical benefits that go beyond simple convenience. Below are the top ten advantages explained in detail.

No foreign transaction fees

One of the most important advantages is the absence of foreign transaction fees. Traditional banks typically charge between 2 percent and 5 percent on every international transaction. Over the course of a trip, this adds up quickly. Best Travel Debit Cards remove this fee entirely, allowing you to spend at the real exchange rate.

Better exchange rates

Most top travel debit cards use real-time exchange rates or interbank rates rather than inflated bank rates. This ensures you get fair value every time you pay or withdraw money abroad.

Easy access to cash worldwide

Best Travel Debit Cards are usually linked to global ATM networks, allowing you to withdraw local currency in almost any country. Some even reimburse ATM fees, which is a major bonus for frequent travelers.

Improved budgeting and spending control

Since debit cards use your own funds, they naturally encourage responsible spending. Many travel debit cards come with mobile apps that provide instant transaction alerts, spending summaries, and budgeting tools.

Enhanced security features

Modern travel debit cards offer advanced security, including instant card freezing, location-based controls, and biometric authentication through mobile apps. If your card is lost or stolen, you can take action immediately.

No need to carry large amounts of cash

Carrying cash increases the risk of loss or theft. Best Travel Debit Cards allow you to pay directly for goods and services or withdraw cash as needed, reducing your reliance on physical money.

Seamless online and offline payments

Travel debit cards work for hotel bookings, transport apps, dining, and shopping both online and in person. This flexibility is essential in a world where digital payments are the norm.

Multi-currency support

Many Best Travel Debit Cards support multiple currencies within one account. This allows you to hold, convert, and spend different currencies without constant exchange fees.

Transparency and low overall costs

Unlike traditional banks, travel-focused debit card providers are upfront about their fees. Most offer simple pricing models with minimal or zero hidden charges.

Ideal for long-term and frequent travelers

For digital nomads, students, and frequent flyers, Best Travel Debit Cards offer a cost-effective solution for managing money across borders over extended periods.

Things to consider when choosing the best travel debit cards with no foreign fees in 2026

Not all travel debit cards are created equal. Before choosing one, it is important to evaluate several key factors to ensure it fits your travel style and financial needs.

Card availability and supported countries

Make sure the card is available in your country and supported in the destinations you plan to visit. Some cards have restrictions based on residency or regional banking regulations.

ATM withdrawal policies

While many cards advertise no foreign fees, they may still limit free ATM withdrawals. Check monthly withdrawal limits and whether ATM fees are reimbursed.

Exchange rate transparency

Look for cards that use real exchange rates without hidden markups. Transparency in currency conversion is essential for saving money abroad.

Mobile app functionality

A strong mobile app is critical in 2026. Features like instant notifications, spending analytics, card freezing, and customer support can significantly improve your experience.

Customer support quality

When traveling internationally, responsive customer support matters. Choose a provider known for reliable and accessible support channels.

Account fees and maintenance costs

Some travel debit cards are free, while others charge monthly fees for premium features. Weigh the benefits against the costs based on how often you travel.

Security and fraud protection

Ensure the card offers strong security measures, including two-factor authentication, transaction alerts, and protection against unauthorized transactions.

Ease of account funding

Check how easy it is to add money to your account. Options like bank transfers, card top-ups, and salary deposits provide flexibility.

Integration with digital wallets

Compatibility with mobile payment systems makes everyday spending more convenient and reduces the need to carry a physical card.

Reputation and longevity of the provider

Choose providers with a proven track record. Stability and regulatory compliance are important for long-term peace of mind.

Top 10 Best Travel Debit Cards with no foreign fees in 2026

Below is a curated list of the Best Travel Debit Cards that stand out in 2026 for their reliability, features, and zero foreign transaction fees.

Wise Debit Card

Wise remains one of the strongest options for international travelers. Its biggest advantage is real exchange rates with transparent fees. The card supports dozens of currencies and allows you to hold and convert money easily. It is ideal for travelers who want clarity and fairness in currency exchange.

Revolut Debit Card

Revolut is known for its multi-currency accounts and advanced app features. It offers fee-free foreign spending within limits and competitive exchange rates. Revolut is a great choice for tech-savvy travelers who value control and flexibility.

Charles Schwab High Yield Investor Checking Debit Card

This card is popular among frequent travelers for one key reason: unlimited ATM fee reimbursements worldwide. Combined with no foreign transaction fees, it is an excellent option for those who rely heavily on cash withdrawals abroad.

Capital One 360 Debit Card

Capital One offers a straightforward travel-friendly debit card with no foreign transaction fees. It is backed by a major financial institution and is easy to use for travelers who prefer traditional banking with modern benefits.

N26 Debit Card

N26 is a digital bank designed for international use. Its debit card offers fee-free foreign spending and a clean, user-friendly app. It is particularly attractive for travelers in Europe and beyond who want a minimalist banking experience.

Monzo Debit Card

Monzo provides fee-free spending abroad and uses real exchange rates. Its app offers excellent budgeting tools and instant notifications. Monzo is ideal for travelers who want simplicity combined with strong financial insights.

Starling Bank Debit Card

Starling Bank stands out for its zero foreign fees and strong customer service. The card offers competitive exchange rates and is well-suited for frequent travelers who want reliability without complexity.

SoFi Debit Card

SoFi offers no foreign transaction fees and reimburses ATM fees in many cases. It integrates well with a broader financial ecosystem, making it a good choice for travelers who also want to manage savings and investments.

Currensea Debit Card

Currensea links directly to your existing bank account and allows you to spend abroad with minimal fees. It is a good option for travelers who want the benefits of a travel debit card without opening a new full bank account.

Payoneer Debit Card

Payoneer is popular among freelancers and international business travelers. It supports multiple currencies and offers competitive foreign spending rates. It is especially useful for those who receive payments from international clients.

Conclusion: the Best Travel Debit Cards with no foreign fees in 2026

Choosing one of the Best Travel Debit Cards with no foreign fees in 2026 can significantly improve your travel experience. The right card helps you save money, avoid stress, and manage your finances more effectively while abroad.

Here are some of our popular posts: Top 10 best website builders, Best super foods for a healthy lifestyle, the unlimited list of free productivity apps, Best freelance site to find remote jobs, top 10 productivity hacks for entrepreneurs , 10 best side hustles to make extra money online, best online courses for learning digital skills, top 10 best free coding website

Before traveling, notify your card provider of your trip if required, even though many modern cards no longer need this step. Always keep your mobile app updated and enable transaction alerts. Carry a backup card in case of emergencies, and avoid dynamic currency conversion when paying at terminals, as it often comes with poor exchange rates.

Use ATMs from reputable banks, monitor your balance regularly, and freeze your card immediately if you suspect any suspicious activity. These simple habits can go a long way in protecting your money while traveling.

As travel continues to evolve, staying informed about financial tools is more important than ever. We regularly publish in-depth guides, comparisons, and practical tips to help you make smarter decisions when it comes to money, travel, and digital finance.

If you found this guide helpful, we invite you to come back to our blog for more expert insights on Best Travel Debit Cards, international banking tips, and other resources designed to help you travel smarter in 2026 and beyond.